Smarsh, a cloud-based archiving solution for financial advisors, recently released their annual Electronic Compliance Survey Report. In its fourth year, the Smarsh survey seeks to identify trends and concerns in financial services.

This year’s results reinforce the shift in attitude toward an acceptance of more types of electronic messages (and the compliance ramifications). In 2013, failure to meet electronic messaging compliance obligations was the number one source of FINRA fines. Noncompliance is an increasingly expensive proposition, increasing by 132 percent during the last survey period.

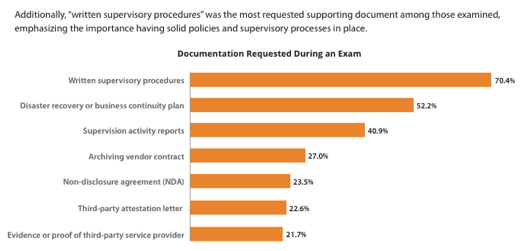

The SEC will target firms registered for more than three years and that have not yet been examined. How can you prepare for exams? Here is what you need to know.

Navigating Complexity - How Does Compliance Keep Pace?

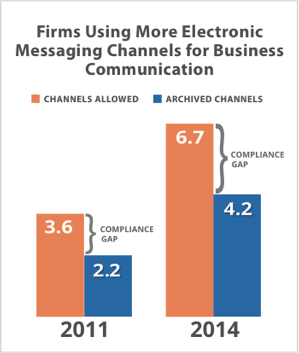

The number of electronic messaging channels that firms allow employees to use for business purposes has nearly doubled in the past three years and compliance programs are not keeping pace. From email to instant messaging, social media and more, the number of message types archived has nearly doubled in three years from 2.2 to 4.2, however there is still a large gap between messaging types in use and those being archived.

LinkedIn continues to be the most highly requested electronic messaging platform, followed by instant messaging, text/SMS messaging and Twitter. Compliance officers expect resources devoted to the oversight of electronic communications to have little change in the next year, so with more communications to manage but little resources to do so, compliance pros are looking to technology to help them gain efficiencies.

“83% of respondents agree that a single platform to manage and search messages from various communications channels is important or critically important to a comprehensive electronic message compliance program.”

Don’t Ignore Text Messaging

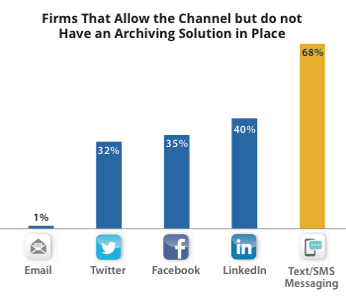

Often a casual communication method between friends and family, text/SMS messaging is becoming prolific in the financial services world. Investors want to text their advisors from their mobile phone, in fact more than 39% already to so. Despite the widespread availability of text messaging, however, it is not receiving the same level of attention from compliance departments as email or social media. Over 2/3rds of firms that allow text messaging do not have a solution in place for retention and oversight.

The lack of attention to text/SMS messaging exposes firms to risks, especially with the wide adoption of mobile devices by advisors. As firms begin to leverage more sophisticated technology, the next evolution in supervision will enable firms to correlate data so that text message conversations will become a critical element of risk-based surveillance.

RIAs Need to Be Prepared

More than half of RIAs (53 percent) are concerned about their ability to produce data upon request, compared to 29 percent of BDs. When asked about their concerns related to exams, BDs and RIAs both indicated their largest concern is increased scrutiny/enforcement by regulators. However, RIAs have had less rigorous supervision requirements under the Investment Advisor Act of 1940.

The SEC accounted an initiative to increase the number of exams in 2014, targeting 2,200 registered firms that have never faced an SEC exam. These exams will focus on compliance programs, filings and disclosures, marketing, portfolio management and safekeeping of client assets. For both RIA and BD firms not subjected to a recent exam, it is helpful to understand the experience of firms examined in the last year.

The top message types requested are:

- Website pages

- Instant messages

- Bloomberg or Reuters messages

- Social media

- Email marketing

- Text/SMS messages

For more information on communication trends and compliance, download the full survey report here or call Financial Social Media at 800.837.6330 x7.

Amy,

We are just now beginning to leverage our social media strategy and have referenced this Smarsh study in the way we are creating our supervisory compliance procedures. Thanks for the post as it’s interesting to see what other RIA’s have been through. The text messaging component is interesting as I normally brush off any corporate text message I get. Are you seeing a lot of advisors using text messaging?