This is the first part of a 5 week series on the evolution of marketing in the financial services industry. The series will cover the new and old marketing tools used by Financial Advisors, their advantages and disadvantages, the compliance rules about social media and will showcase 12 advisors that have been successfully incorporating social media in their marketing plan. In today’s article, we will briefly cover the transition that has been taking place over the past couple of years, moving from traditional snail-mail campaigns to community engagement using social media.

From Snail-Mail to Social Media

Financial Advisors have traveled a long way from some of the very old marketing tools to the newest high-end technology based tools.

Today, your clients and prospects habits have evolved along with the marketing industry. They have access to millions of pages online and will not tolerate to be treated as a number in your mailing list or continue to be fed with old snail-mail marketing pieces. They want to be recognized as individuals and be treated as such. Instead, they will look for the information online, whether it is on websites, blogs or social media sites. Your goal as a financial advisor is to get found on all these different platforms. This means having an updated website, creating value on your blog and engaging with your community on Twitter, Facebook or LinkedIn.

General statistics show that 77% of active internet users read blogs to share news, information, stay in touch and make new connections. Statistics also show that consumers are more likely to do business with a company that is active online.

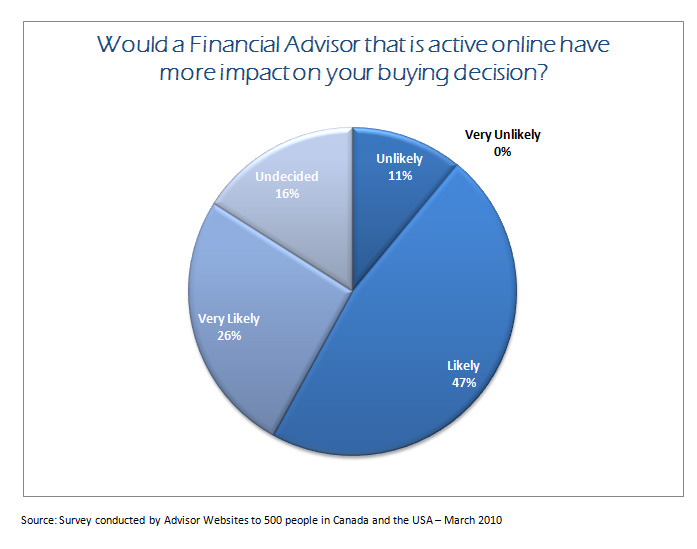

I wanted to get more results within the financial industry and decided to conduct a survey, asking the following question:

Would a Financial Advisor that is active online have more impact on your buying decision?

The results were in line with the recent global statistics:

None Voted Very Unlikely

11% Voted Unlikely

47% Voted Likely

26% Voted Very Likely

And 16% were undecided

Out of the 500 people we polled, 365 really believed that your online presence would influence their buying decision (and only 55 don’t think so).

Of course, we are still on the early stages of social media, financial advisors have only started to use social media over the past 12-18 months and therefore there are still some compliance issues, structural issues and concerns about the real impact on your ROI.

Leading the Way

We are aware of a few financial services professionals that immediately took the lead and adopted online marketing and social media early in the making. One example is Timothy Sykes, who started blogging years ago, has been recognized as one of the top marketer in the industry, was interviewed numerous times on online marketing and has over 5,000 avid followers on Twitter.

In other words, if you are not online yet, get on it as soon as you can. Start by defining a clear online marketing strategy, short-list the top websites you should have a profile on and start creating value and engaging with your target market.

If you already have a profile on Twitter, are blogging once or twice a week and haven’t seen any increase in traffic or qualified leads, do not despair, you always reap what you sow. Stick to your game plan, maybe increase your number of blogs, try to attend local Meetups and connect with thought leaders in your industry, follow them on twitter and engage their followers. The results shall come!

Loic, I love how you position this from a client perspective and tie it to the buying decision. It is this kind of analysis and data that will provide the wake-up call that advisors and their firms need to justify the exploration and implementation of social media tools for their advisors. In the financial services business everything demands an ROI and they love numbers. Good stuff. @victorgaxiola

As Community Manager at linkedFA - the first industry compliant social network for financial pros and investors, I can attest to the rapid change. Things are moving quickly, and as our CEO put it, FA’s need to master social media or get run over.

Great post Loic. Just one thing: Typo in last paragraph… reap what you sow?

Thanks for sharing this.

Victor: thanks for the comments. I totally agree with you that the financial industry needs more data and in-depth analysis on the true impact social media (and online adverting in general) has on the reps credibility and ability to take their business online. Time is of the essence as we ‘celebrate’ 1 year of FINRA 10-06.

Alex: your CEO’s view on the possible outcome for the FA’s that don’t get on board with social media in time is spot on. You need to live were your clients/prospects live online. And today, it’s facebook, twitter, linkedin etc. BTW, thanks for the typo notice!